Published on March 23rd, 2023

By Megan Eales Monroe

When it comes to financial flexibility, it’s pretty much guaranteed your residents are not only incredibly familiar with the concept but also taking advantage of it across their daily lives, with a wide range of diverse payment solutions. This includes using alternative banking options, mobile and online payment methods, and installment payments like “buy now, pay later.”

Because financial flexibility is the new norm for consumers, it’s only a matter of time before it becomes standard for property management companies, too. While it may seem like a relatively new concept for the rental housing industry, financial flexibility solutions offer myriad benefits for both residents and property management companies. This is especially true when it comes to rent payments and security deposits.

To dive deeper into why property management companies should consider offering residents more financial flexibility through flexible rent payments and security deposit alternatives, we spoke to Adam Feinstein, Head of Product for AppFolio Payments, and Sean Saxena, Sr. Director for FolioGuard™ by AppFolio Insurance Service.

Use the player below to hear what they had to say about financial flexibility on The Top Floor podcast, or keep reading for need-to-know highlights from their conversations.

While single, in-full, and fixed monthly rent payments are still the standard today, by making paying rent as flexible as possible for residents, property management companies canbe more in touch and in alignment with how people actually earn their income today. As Adam Feinstein explains:

“How people are earning their income is one key trend that connects with financial flexibility. And we’re seeing that trickle into rent. So really, that flexibility is about making it easy and worry-free for them to be able to make this payment, which can be 30 to 50% of their overall income in any given month, and do it in a way that matches when they get paid.”

In addition to mirroring the diverse ways residents get paid and want to pay their rent, offering flexible rent payments comes with other benefits, too. For example, by simply making it easier to pay rent in general, property management companies can help mitigate late payments and non-payments, spend less time following up with residents, better manage cash flow and NOI, and increase the speed in which payments are made to owners, vendors, and financial institutions.

In addition, Adamnotes that offering flexible rent payments doesn’t automatically mean property management companies will need to take on additional operating burdens or disrupt existing workflows, especially when the right technology solution is in place:

“Technology has helped really add a level of flexibility for everybody. From a resident’s perspective, they can go into a portal and use a flexible rent offering. And from there, it’s collecting some necessary information so providers and partners can make sure property management companies get paid. And it’s really working to take that pain away from the property manager and facilitate the collection.”

What are security deposit alternatives?

Although it’s an essential and standard component of the rental agreement process, the traditional security deposit can be a burden for both renters and property management companies. That’s because a typical security deposit is required up front and all at once, which can create additional barriers that slow down the entire move-in process. As Sean explains:

“From a resident’s perspective, you have to give up a pretty significant amount of money, and you can’t move in until you drop off the security deposit at the office. It’s a pain for property managers. You want your move-in process to be as seamless as possible and diminish the amount of time it takes between when you have an open unit to when you fill the vacancy. And the truth is security deposits create friction in that process.”

Security deposit alternatives can help make the entire unit turn process easier and quicker for everyone. In addition, they still help provide the same levels of protection property management companies would normally get with a cash deposit, since they’re an alternative, not a replacement. As Sean notes:

“We’re not removing the security deposit; we’re providing an alternative. And there are a variety of different security deposit alternative models that keep residents accountable. It allows them to move in, without having to forego the whole amount of the security deposit, but still create transparency that they are responsible for any damage that they may create.”

Making financial flexibility a win-win for everyone

By modernizing the property management industry’s approach to collecting rent payments and security deposits, two major pain points can be alleviated for residents and property management companies. In addition, using the right technology and solutions can help ensure the process is seamless, secure, and compliant, which also creates a win-win for everyone. After all, the easier it is to pay, the better the outcomes for everyone.

To learn more about how you can improve your resident experience, download our free guide below.

Comments by Megan Eales Monroe

Consistency Is Key: 5 Ways to Help Property Management Teams Work More Effectively and Efficiently

Hi there Ryan! We definitely have solutions that make sense ...

How Will Rent Control Impact Property Management Companies in 2020?

Hi Frank - the Consumer Price Index (CPI) is used as a ...

What is AI, and How is it Transforming the Real Estate Industry?

Hi there, Kim! The price depends on your business' ...

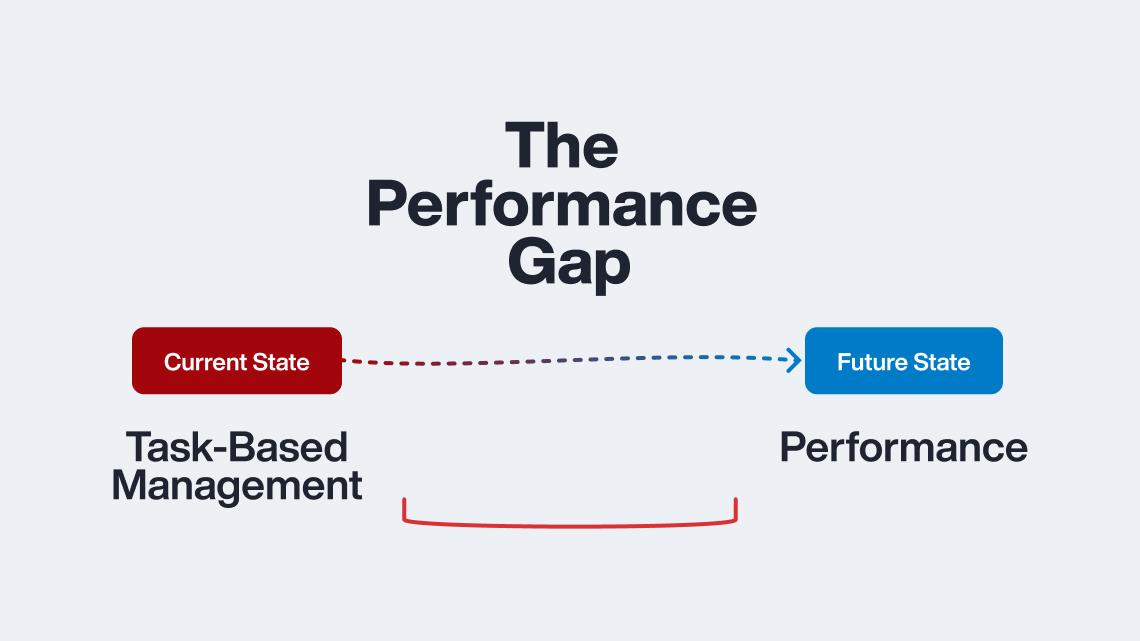

There’s a Better Way to Get Work Done: How to Maximize Team Performance through Experience

Hi Amanda, We'd be happy to provide you with more info! ...