Published on September 17th, 2024

By Kwame Donaldson

Over the past year, a surprising sense of steadiness has settled over the multifamily rental market. Join us for a data-backed dive into the forces at play and the ways this could all change.

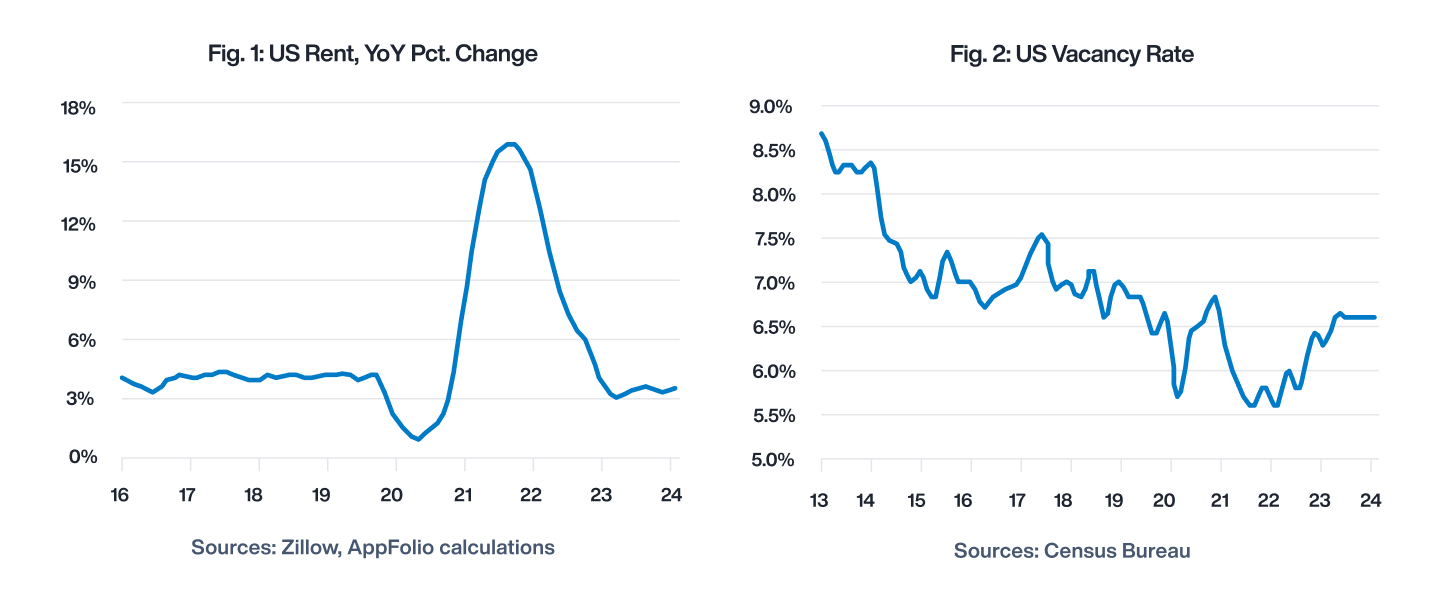

Traditionally volatile indicators of the residential rental market have held steady through the first half of 2024. Year-over-year rent growth — after soaring to nearly 16% in 2022 — has settled between 3.4% and 3.5% for each of the last 10 months, and the rental vacancy rate has locked in at 6.6% for each of the last four quarters, the longest period of stability in the 68-year history of the series.

Renters and apartment owners across the United States are the beneficiaries of a Goldilocks scenario: A record number of multifamily properties are being completed just as elevated immigration levels, a large population of twentysomethings, and higher housing costs are boosting the demand for apartment units.

But this equilibrium likely won’t last. Data from the US Census Bureau shows a double-digit decline in the number of rental properties currently under construction, which means that supply will soon retreat from this year’s near-record levels. Changes in demand are harder to forecast, but they should also decline as the Fed eases interest rates, housing affordability improves, and some renters transition into homeownership. Demand is likely to decline further as immigration to the US recedes from the 21-year high that it reached last year. Whether nationwide rents and vacancy rates move higher or lower ultimately depends on whether the pullback in supply will be greater than the slowdown in demand.

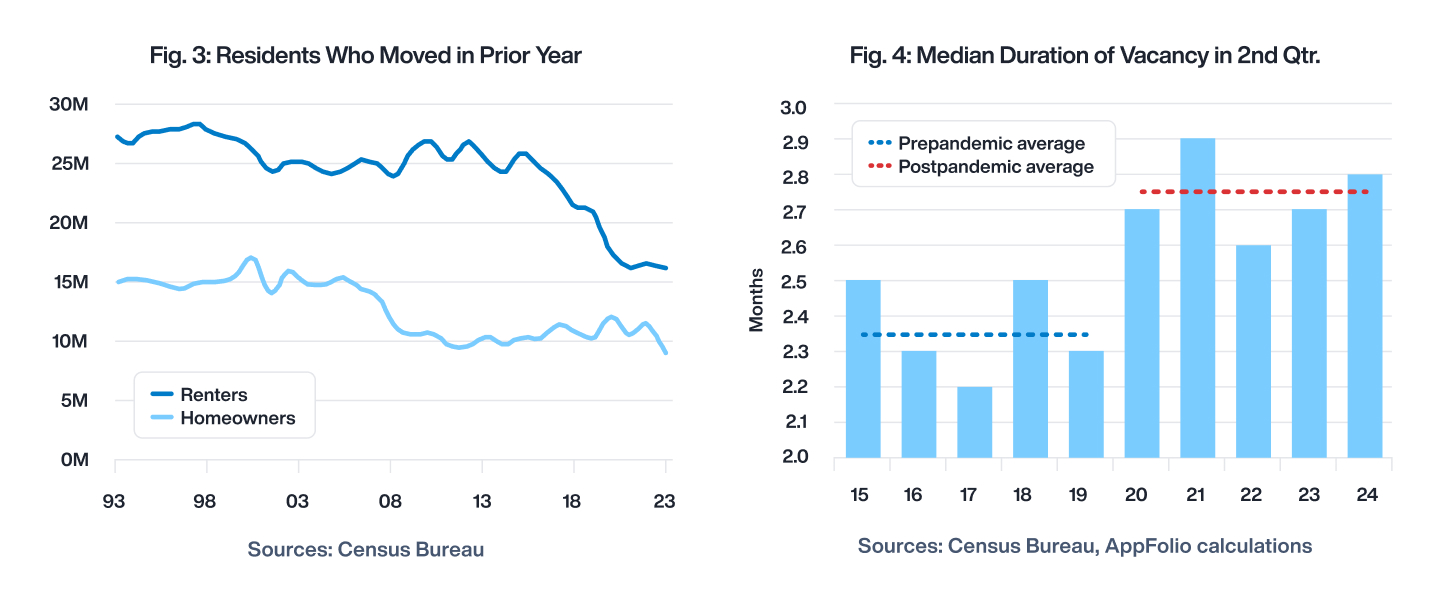

Recent indicators are not the only sign of nationwide stability in the rental market. According to the Census Bureau, the number of renters who moved in the previous 12 months has held steady for three consecutive years after being slashed by one-third between 2011 and 2021.

Additionally, the median duration of rental unit vacancy in the second quarter of 2024 was 2.8 months, just two days longer than the average over the last five years.

While many individual markets may outperform or underperform these indicators, nationwide steadiness is good for the residential market in general. When supply and demand grow in tandem, renters have more options, and their relocation decisions are not frustrated by lack of choice. Property owners have a predictable income stream, which makes their assets less risky and more valuable. Orders for rental units are synchronized with vacancies, so planning to fill them is easier for property managers.

This welcome stability is the result of market forces that are expiring. For instance, today’s steady renter turnover rate is due to the recent slide in the number of first-time homebuyers. Sky-high mortgage rates and rock-bottom housing supply have caused home sales to slip and homeowner turnover to dip to an all-time low (Fig. 3). The longer-term slide in renter move-in activity will resume when housing affordability improves and more renters graduate to homeownership.

Similarly, the median vacancy duration remains elevated due to lingering pandemic effects. Since 2020, the number of days a typical vacant rental property is unoccupied has increased by 12 days (Fig. 4). Precautions that owners and renters instituted in the wake of COVID-19 may be extending the time it takes to switch between occupants. Eventually, these pandemic effects will dissipate, and the rental market will enjoy shorter turnover times. As these temporary forces wind down, conventional economic trends will regain prominence and nudge the rental market toward its long-run equilibrium.

In light of these trends, and especially due to increased relocation choices for renters, resident retention has become more critical than ever. Property management companies will need to prioritize renters’ preferences in order to meet their expectations throughout their entire resident journey — from their initial inquiry to move out and every moment in between.

The 2024 AppFolio Property Manager Renter Preferences Report will help you understand exactly what your current and future renters expect so you can surpass their expectations and stand out in a competitive rental landscape. Check out the report here.

Comments by Kwame Donaldson