Published on December 28th, 2021

By Rae Parker

Our society continues to move toward an online-first approach. These days, the leasing process happens virtually with prospective residents completing everything online — from chatting with agents, to touring units, and submitting applications. Once an application has been submitted, what does your screening process look like?

Knowing whether an applicant is able to consistently afford their monthly rent is an important factor in the approval decision, but inefficiencies and human error can arise if your team has to manually screen and review documents for each applicant.

Not only is it time consuming for your team to verify records or documents like pay stubs and bank statements, it’s also difficult for qualified renters with non-traditional income sources, like self-employed or gig workers, to produce a paper trail of required documents to demonstrate that they indeed have the income necessary to qualify for the unit.

Implementing technology that can verify income at the click of a button saves your team so much time, all while reducing fraud and taking human error out of the process.

A New Wave of Renters

Employment in the gig economy is becoming a growing trend, now representing more than 57.3 million Americans. This segment of the labor market is made up of workers whose employment is outside a traditional full-time or part-time model, and instead they take on short-term jobs that cater to their schedule.

We sometimes think of gig workers as those who support apps within the car services or food-delivery space, but it also includes those who work in web and graphic design, programming and production, and IT. A poll conducted by Gallup, 36% of U.S. workers participate in the gig economy as either their primary or secondary jobs. A similar study by Edison Research and Marketplace found that roughly 44% of all workers claim their work in this economy as their primary source of income.

It can be harder for those 57.3 million Americans to provide pay stubs or documents that can consistently show they’re bringing in the income you’re looking for. However, utilizing the right technology to reduce the manual process of verifying income can help fill your vacancies and broaden your reach of finding the most qualified renters, no matter how they earn their income.

The Downsides of Manual Screening

One of the most critical aspects of the resident screening process is verifying that your prospective candidate has the means to consistently support themselves in their new home. Income verification is a step within the application process where the resident will provide documents to support their claim of their current income level. Common documents that are used include pay stubs, proof of income from their current employer(s), tax documents, or bank statements. While all of these are appropriate to provide, there is some risk of receiving fraudulent and forged documents, along with the inherent security risk of sending or emailing financial documents.

According to a study by Snappt, 2 out of 3 property managers stated that they have fallen victim to fraudulent rental applications.

Less dramatically, your team could simply be overwhelmed by the volume of documents to manually verify, and the process can be subject to human error. With no automated technology to verify these documents, property managers have to look for potential forgeries or alterations manually. 58% of property managers rate this task as “somewhat to extremely” challenging, and 50% say it takes too long to do.

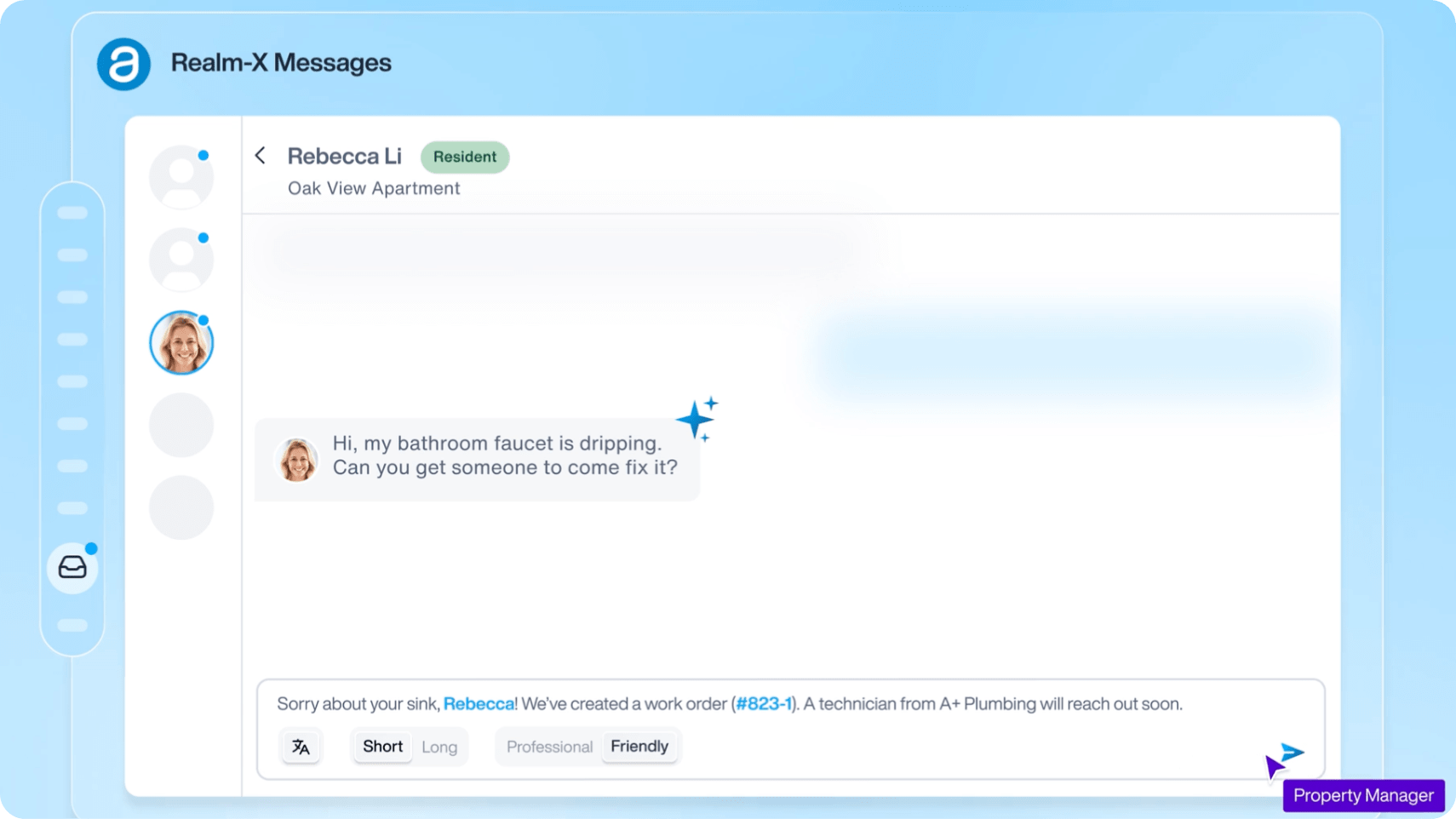

Implementing software that automates the process of income verification via bank integration leads to instant access to verified income, quicker and informed leasing decisions so that vacancies are filled faster, and a more complete view of the applicant’s financial status.

A Faster, More Inclusive Screening Process

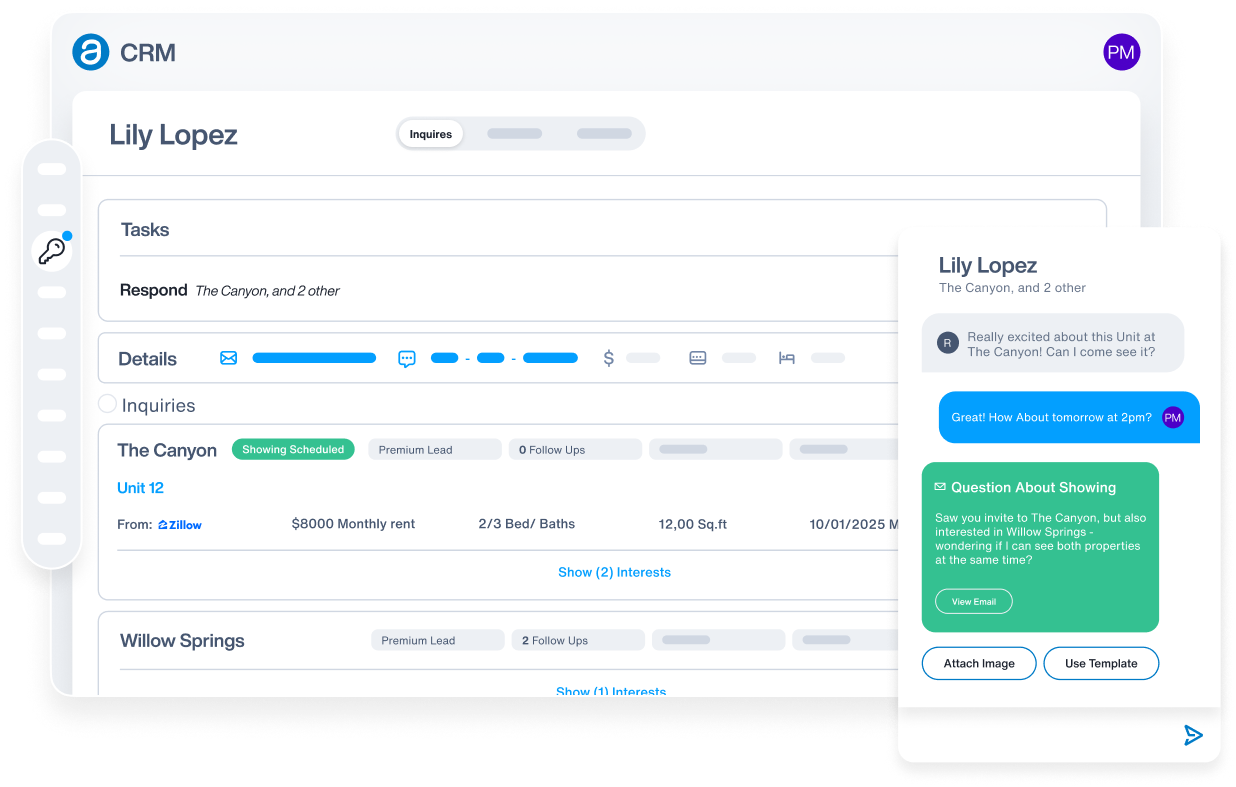

To streamline and provide a better standardized screening process, look to software services that take a holistic approach to resident screening. Built directly into AppFolio Property Manager’s Tenant Screening software, the income verification process gives applicants the option to enter in their online banking information directly within their application. Rental applicants still have the option to upload any documents that can verify their income, however, bank integration provides a faster flow of the application process and reduces the risk of sending or emailing financial documents.

Using an encrypted website that protects their data and keeps their bank log-in information private, prospects can search for their banking institution and choose which bank account they would like to authenticate. Once their application is successfully completed, you can immediately review a Screening Report that provides you with an overall summary that includes a summary of estimated historical and projected salary; estimated primary source of income that displays active/inactive statuses and frequency; latest deposits from their estimated primary income source; and other important financial information to further help you make informed decisions.

Since using AppFolio’s Income Verification Screening feature, Mike Fazio of Elevation Real Estate has been able to streamline their leasing operations across portfolios, resulting in a faster turnaround on application processing: “AppFolio’s Income Verification functionality has generated a report that is clear, concise, and has proved to be beneficial to both our team members and our prospective residents.”

Download this free guide for more ways to optimize your leasing processes.

Owen Liske

—

Extremely, a very nice information about using technology to verify income and other prospect related to tenant screening. Thanks a lot providing this kind of information.